Factsheets

Protecting copyright and Artist’s Resale Right after death

Copyright and the Artist’s Resale Right are valuable assets that allow artists to generate an income from royalties during their lifetime and for 70 years after their death.

An artist should make specific provisions regarding these rights in a Will to ensure they pass in accordance with their wishes.

This factsheet covers the following:

Throughout this document we will be referring to the Artist’s Resale Right Regulations 2006 (“the Regulations”), a copy of which is available on the right-hand side of this page. There's more information about the Artist's Resale Right here too.

Copyright in artistic works currently lasts for 70 years from the end of the calendar year in which the artist died.

The Artist’s Resale Right lasts for as long as the copyright in an artist’s work. On 1 January 2012, the right was extended to the beneficiaries of deceased artists; until then royalties could only be collected in the UK for living artists.

Clear provisions relating to copyright and Artist's Resale Right should be made in an artist's Will to ensure these assets pass in accordance with their wishes.

The recipients of assets forming the subject of a Will are called ‘beneficiaries’. It is important to remember that copyright and the Artist’s Resale Right are two distinct assets and should be referred to separately in a Will, even if the beneficiary is the same.

An artist can choose to leave their copyright to whomever they wish. They can leave the copyright in all of their artwork to one person, or to an institution such as a gallery or museum. Alternatively they can leave the copyright in certain specified works to different individuals, or specify the percentage share of copyright to which different named individuals are entitled.

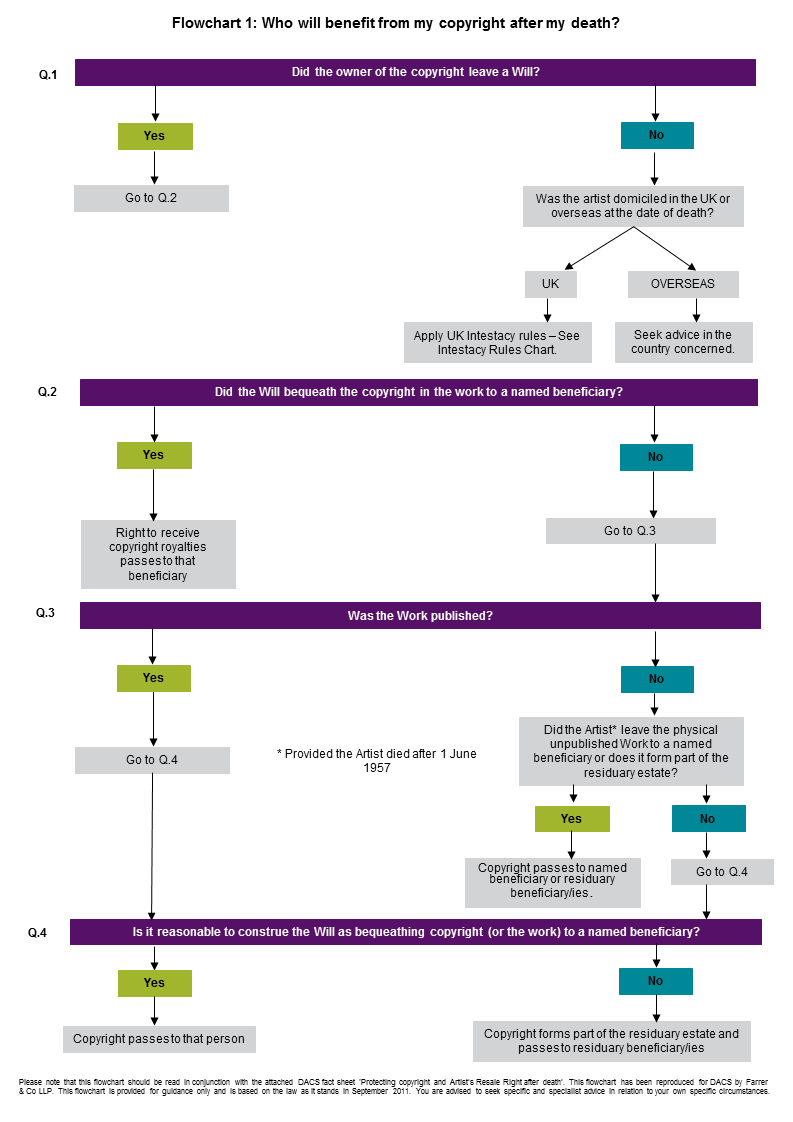

Where an artist has a Will but has not made a specific bequest in relation to their copyright, different rules will apply. Illustration 1 below shows how this works (click on the image to download as a pdf, or see the right-hand side of this page):

The rules set out in this section apply to artists who died on or after 15 February 2006, when the Regulations came into force. Only works of graphic or plastic art protected by copyright qualifies for a resale royalty.

The Artist's Resale Right (Amendment) Regulations 2011, which came into effect on 1 January 2012, ensure that the Artist's Resale Right can be inherited by a qualifying body (which has to be a charity) or a natural person. This was changed from the original wording of the Regulations where only beneficiaries of qualifying nationality were able to inherit and exercise the Artist's Resale Right after an artist. Under the new version only the artist had to be of qualifying nationality, which means a national from the UK or any other state within the European Economic Area.

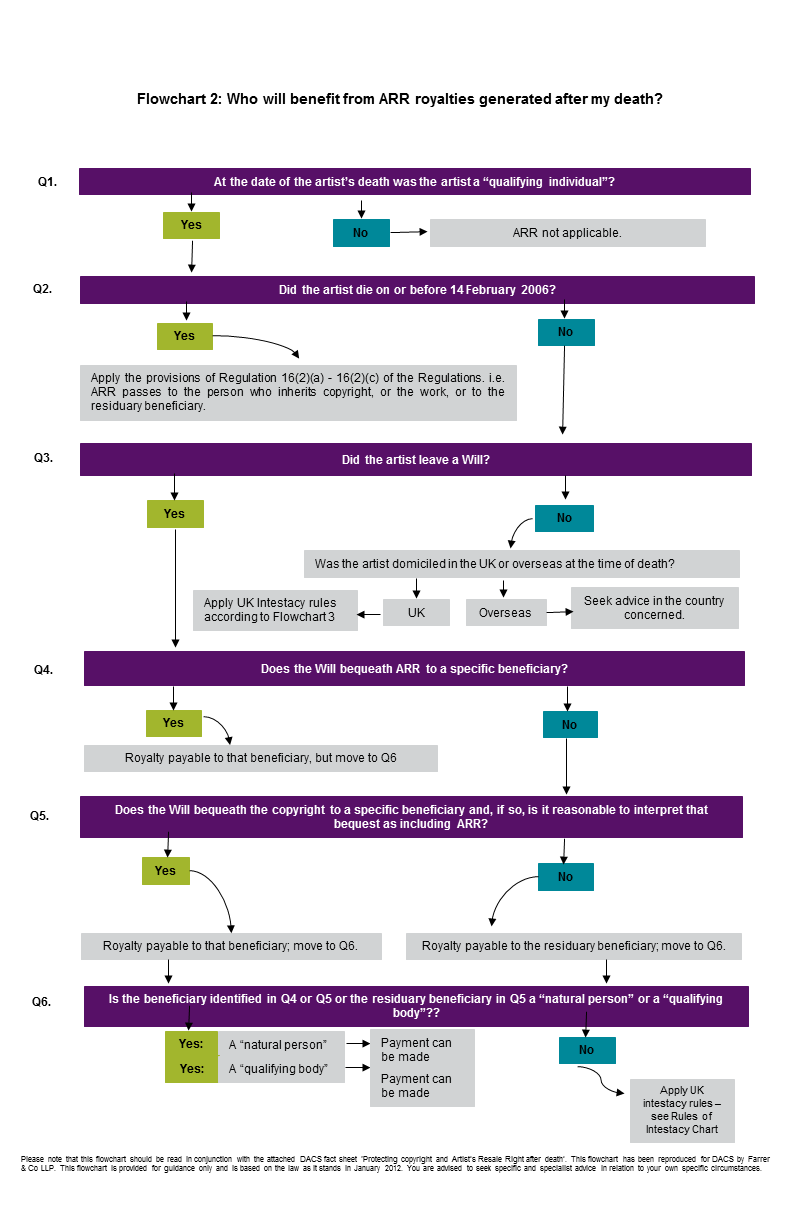

The rules become extremely complex if an artist has a Will but has not made a specific bequest to leave the right to a charity or qualifying individual. Firstly, where a bequest is made in relation to copyright and it is reasonable to interpret that bequest as including the Artist's Resale Right, then the Right passes to the person or body entitled to copyright.

Where this is not the case however, the Right may pass to a qualifying "residuary beneficiary", or the person or body entitled to the remains of the estate after the payment of all legacies, debts and expenses. If there is no such person appointed in the Will the Right passes in accordance with the UK intestacy rules and may ultimately fall to the Crown.

Illustration 2 below shows how these rules work:

The Artist's Resale Right came into effect on 14 February 2006. If an artist died on or before 14 February 2006, the Right passes in accordance with the rules set out in Regulations16(2)(a)-(c) of the Regulations, the so called transitional provisions. (LINK)

Under Regulation 16(2)(a), where the artist owned the copyright in a work immediately before his or her death, the Artist’s Resale Right is deemed to be transmitted to the person who inherits the copyright in the work.

Different rules apply where the artist did not own the copyright immediately before his or her death or where the artist was one of a number of joint authors.

As these provisions link the transfer of the Artist's Resale Right to the transfer of copyright in a work or the individual work itself (Regulation 16 (2) (b)) this can become very complex and it is advisable to seek legal help in interpreting the Will and in applying these provisions.

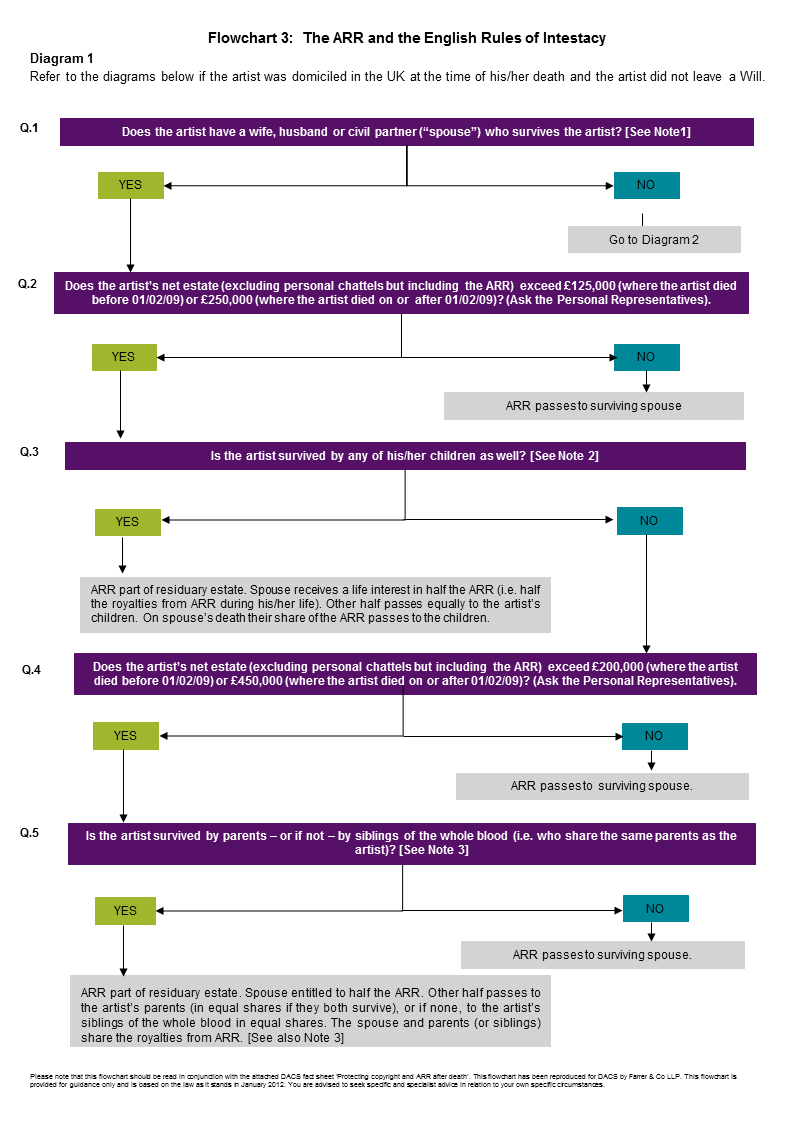

If an artist is domiciled in the UK and they have not made a Will, then all of the assets which are in their sole name, including all real and personal property, money, artwork, copyright and Artist's Resale Right, will pass to their next of kin in accordance with the rules of intestacy. These rules dictate how and to whom an estate will be distributed and as such this may not be in accordance with the wishes of the artist.

Illustration 3.1 below sets out the English rules of intestacy:

If no spouse survives, see Illustration 3.2 on the right-hand side of this page.

The content of a Will should be tailored to an artist’s individual circumstances. It is therefore highly advisable that artists consult a solicitor who will be able to advise them on how best to deal with their estate.

Below are a number of issues an artist may wish to consider when making a Will, with particular emphasis on copyright and the Artist’s Resale Right. It is by no means intended to constitute an exhaustive list of everything that you need to consider when managing your estate.

-

Ensure the Will is valid. A common mistake in making a Will is failing to comply with formal requirements necessary to make a valid Will. Doing so not only means that an estate may not pass in accordance with the artist's wishes, but it may also lead to disputes after an artist’s death. Artists should engage a solicitor to draft a Will on their behalf. Alternatively, a number of trade unions offer a free Will writing service to their members.

-

Formalise any changes to a Will. If an artist already has a Will but their intentions have changed since it was drafted, they will either need to revoke their existing Will and create a new one, or add a codicil to their existing Will. Artists should consult a solicitor in these circumstances as there are certain formalities with which they must comply and simply adding to a Will may risk invalidating the whole Will. Likewise, drafting a new Will may implicitly revoke the existing Will or external factors like a marriage or civil partnership may render existing Wills invalid. Artists who created a Will before the Artist's Resale Right was introduced should seek advice on whether to amend an existing Will in order to deal with Artist's Resale Right explicitly.

-

Make executors aware of any assigned rights. Those in charge of managing the estate should be told if an artist has assigned or sold the copyright in any of their artworks. This may be particularly relevant for illustrators and photographers, who often work to commission and may have assigned the copyright in their works under the terms of their contract or where artists worked as employees or war artists. A comprehensive list outlining who owns the copyright in all of an artist’s works could prove invaluable to executors when managing the estate.

-

The physical artwork and the copyright embodied in it are two distinct entities. This means that making a provision to leave a specific artwork to an individual or organisation does not necessarily mean that they will be entitled to the copyright embodied in it. Where an artist died before 14 February 2006, entitlement to the Artist's Resale Right follows the entitlement to copyright or the physical work in certain circumstances.

-

Name beneficiaries clearly. To ensure that copyright passes in accordance with an artist’s wishes, specific bequests should be made by naming the individuals or organisations to inherit copyright. If an artist is not leaving all of their copyright to one individual they should make it clear who is entitled to the copyright in certain works or whether they would like all of their copyright to be split between certain individuals, and if so in what percentages.

-

Include the Artist's Resale Right. Even if an artist’s work has not yet qualified for Artist's Resale Right royalties, it is still important to make a provision in a Will in relation to the Artist's Resale Right as the work may qualify in the future. Here's more information on how works qualify for the Artist's Resale Right.

-

Ensure the beneficiaries qualify. The Artist's Resale Right can only be left to certain charities or a natural person.

-

Consider all circumstances. An artist should ensure that they have made provisions in their Will for the possibility that a beneficiary may die before they do. For instance, if an artist is leaving their copyright to x, their Will should state who is entitled to the copyright in the event that x dies before them. This avoids uncertainty and will help to ensure that an artist’s assets pass in accordance with their wishes.

-

Appoint executors to administer a Will. Executors are responsible for gathering together all of the assets of the estate and paying from it any debts, taxes, funeral expenses etc. Commonly appointed executors include relatives, friends, solicitors or accountants. Where the estate is large and complex and the extra expense is justified, banks and trust corporations may also be appointed as executors.

Disclaimer: This factsheet is offered as a general guide to the issues surrounding copyright in this area. It does not represent an exhaustive account. It is not intended to offer legal advice and should not be relied upon as such. We strongly recommend you seek specialist advice for any specific circumstances.